Pricing your products or services can be tricky. You want to set prices that maximize your profit and revenue while also factoring in market demand, your target audience and what motivates them to buy.

Pricing isn’t as simple as looking at what your competitors charge and adjusting your rates by a few dollars. A lot more thought goes into an effective pricing strategy. There’s a whole psychology behind it.

People have emotional triggers, judgments, and certain perceptions when it comes to prices and spending money. And pricing or discounting offers in certain ways can have a bigger impact on your audience and consequently, on your sales. Research shows that businesses see an increase in profits by an average of 11.1% for every 1% improvement in pricing optimization.

So how do you know if your prices are on target?

Below, you’ll learn seven strategies and best practices for pricing your ecommerce offers.

(Note: None of these tips should be taken as gospel. As always, you need to test to see what works best for your business.)

Use Price Anchoring To Establish Your Offer’s Value

Anchoring is the “common human tendency to rely too heavily on the first piece of information offered (the ‘anchor’) when making decisions.”

In general, we, as humans, are not super savvy when it comes to understanding the intrinsic value of things. As a result, we use exterior information to determine the “right” price for a particular item.

Psychologists Tversky and Kahneman suggest offering people an initial number (an anchor) causes them to base their estimations of unknown prices off of that anchor number. And to a large extent, they’re right.

For instance, seeing a pair of $996 leather pants makes a similar pair of $198 black pants with leather detailing seem like a steal in comparison.

In this example, $996 operates as the anchor price and shoppers base their assumptions about the cost of the second pair of pants on this rate. And upon seeing the contrast in price between the two pairs, customers are more likely to view the $198 pants as more affordable (even though they’re still expensive). Thanks to the anchor, customers perceive the $198 pants as being worth more.

“Nothing is cheap or expensive by itself, but compared to something,” says Peep Laja. “Once you’ve seen a $150 burger on the menu, $50 sounds reasonable for a steak. At Ralph Lauren, that $16,995 bag makes a $98 T-shirt look cheap.”

Encouraging people to compare prices can sometimes backfire, though, especially when you compare your prices to your competitors’ (more on this later). So to optimize your results with anchoring, try positioning premium products or services next to basic options to give customers a better sense of your offers’ value.

Don’t Price Similar Products Exactly The Same

Pricing similar items—say, two different packs of gum—the same might seem to make sense. However, research findings suggest otherwise. Pricing similar items the same can actually hurt your sales.

According to Gregory Ciotti, “If two similar items are priced the same, consumers are much less likely to buy one than if their prices are even slightly different.

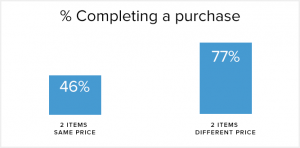

In one experiment, researchers asked participants to choose or ‘pass’ (keep their money) on two different packs of gum. When the packs of gum were priced the same at 63 cents, only 46% made a purchase.

Conversely, when the packs of gum were priced differently—at 62 cents and 64 cents—more than 77% of consumers chose to buy a pack. That’s a huge increase over the first group!”

A slight difference in price prevents customers from falling prey to analysis paralysis so they can make a decision more easily.

This isn’t to say you should price identical items differently. Identical items should be priced the same. We’re talking about items that are similar but not exactly the same.

Here’s another example. Clothing retailers sometimes price shirts differently based on whether the shirt is solid or has a pattern. The shirts are otherwise identical in shape and style. But the solid shirt costs less than the patterned shirt.

Pricing merchandise in this way helps prevent customers from deliberating over whether they like the pattern or solid version better, as this hesitation can hinder customers from making a purchase. When the patterned shirt costs more, customers have to like the design significantly more than the solid version to make it worth the additional expense, which makes the decision easier.

Choose Price Points That End In 9

The power of number 9 is real, folks. A study in Quantitative Marketing and Economics found that “prices ending in 9 were so effective they were able to outsell even lower prices for the exact same product.”

This strategy is sometimes referred to as charm pricing. And it can also be effective with other odd numbers, like 5 and 7, but it’s most effective with the number 9. Customers tend to associate prices ending in 9 with bargains whereas research shows that customers experience pain when they see prices they think are too high. So ending your prices with 9 can literally spare your customers pain.

The “left-digit effect” also factors into why prices ending in 9 are more appealing than whole numbers. According to this behavioral phenomenon, customers pay more attention to the leftmost digit than to the numbers to the right of the decimal point.

Here’s an example involving pens from a study published by the University of Chicago:

“When the pens were priced at $2.00 and $3.99, 44 percent of the participants selected the higher-priced pen. But when the pens were priced at $1.99 and $4.00, only 18 percent of the participants chose the higher-priced pen.”

The price difference between the two sets of pens is almost the same ($1.99 in the first set and $2.01 in the second set). But when you focus on each price’s leftmost digit, the price difference between the second set of pens seems larger than it is. And this perception causes people to pay more attention to how much they’re spending, resulting in more people choosing the less expensive option.

When you shouldn’t choose price points ending in 9

Charm pricing is effective for a lot of businesses. But if you sell luxury items, you’re better off pricing your items using whole numbers. (e.g. $2,000, not $1,999.99). In this case, charm pricing “can give luxury customers the impression that the products are defective or are market down,” says Lindsey Peacock, as people tend to associate whole-number prices with quality and charm prices with value.

Check out the pricing on these purses from Nordstrom’s, a high-end department store:

All of the prices end in whole numbers. These products—and prices—are not for shoppers seeking great value. They’re for shoppers who are comfortable spending money.

Pay Attention To Pricing Punctuation

Pricing punctuation also factors into how customers perceive your prices.

One of the first things you can test is displaying your prices with and without the currency symbol. In some cases, removing the currency symbol causes people to perceive the price as less expensive. Removing the currency symbol can sometimes be confusing, though, as people may not realize they’re looking at the price. You can also experiment with including a currency symbol that’s bigger or smaller than the actual price.

Another thing you can test is including commas in larger prices and decimal points. An experiment was conducted in which people were presented with the following prices:

- $1,499.00

- $1,499

- $1499

All of the prices are the same. But pricing options 1 and 2 were perceived as more expensive than option 3. The reason for this has to do with the way numbers are read verbally: one thousand four hundred and ninety-nine dollars versus fourteen ninety-nine. The latter rolls off the tongue much easier, and so, it’s perceived as less pricey.

Offer ‘BOGO’ Deals

BOGO stands for buy one, get one and it’s a pricing strategy in which customers pay the full amount for one product or service and then receive another for free.

BOGO is a pricing strategy that benefits retailers and appeals to customers. BOGO deals move less popular inventory at a faster rate while still turning a profit. And customers derive extra satisfaction from getting something for free, tending to overvalue and overreact to the benefit of the deal.

For example, consider National Donut Day. People line up outside donut shops and wait—sometimes for extended periods—just to claim a free $3 donut. The value of the time people spend waiting typically surpasses the financial benefit of getting the donut for free. And yet, people go nuts for this.

A BOGO deal doesn’t give something for nothing, though. But it can produce a similar excitement in customers who “are more likely to participate in BOGO promotions because the products seem to have no extra cost and are more valuable due to the deal,” Matt Ellsworth reports.

In other words, people are willing to purchase an item or pay more than they normally would when they know they get something for free in return.

Not every BOGO deal involves getting something for free, however. Some BOGO deals use other discount offers, such as…

Buy one, get one 50% off.

Buy one, get 40% off your next purchase.

Buy one, get 2 free bonuses valued at $100.

Getting some for free tends to appeal to customers more than other types of discounts. But offering something else in your BOGO deal can still be an effective way to boost your sales.

Highlight Price Differences Visually

When you run sales, there are a couple of visual tricks you can employ to make customers more likely to purchase your offer.

First, place the sale price next to the original price. Seeing the price difference makes customers feel like they’re getting a great deal, making them less inclined to want to research other options.

Then, use a different font, size, and color to show the sale price. “This trick triggers a fluency effect and consumers interpret the visual difference to a larger numeral distinction,” reports Pius Boachie. Specifically, you should make your sale price smaller than your original price, as in the example below.

When you distinguish the sale price from the original price using a different color and smaller font, customers perceive the difference between the two prices to be even greater, which can result in more purchases.

Proceed With Caution When Comparing Prices

Comparative pricing involves directly comparing the cost of two similar products or services to make one seem more appealing than the other. Companies most often compare the cost of their products to those of their competitors.

Comparative pricing is a good idea in theory. And for some companies in certain industries, it can be an effective pricing strategy in practice as well. But comparative pricing can also backfire and cause distrust in customers.

Encouraging customers to compare their products to competitors’ is something a lot of marketers do. You see this all the time in drugstores and supermarkets. The store-brand item is positioned next to a national brand with packaging that encourages customers to compare ingredients in the hope that customers will find the products similar enough and choose the less expensive, store brand version.

Again, comparative pricing can be effective. But it can also produce anxiety in customers, causing them to decide not to purchase either option or to choose the brand they know because it’s perceived as less risky. Asking customers to make comparisons in the first place can also make them worry they’re being tricked in some way.

The tendency is for customers “to put greater weight on the comparative disadvantages rather than advantages of each option. This can make the suggested option (in this case, the store brand) less attractive,” says Alice LaPlante.

How To Do Comparative Pricing Right

But this isn’t to say that you should avoid comparative pricing. If you offer customers a reason why your products cost less than your competitors’, you provide context. And this context can put people’s minds at ease, making them feel more trusting.

People often associate quality with expensiveness. But when they know there’s a good reason for an item costing less—one that doesn’t involve sacrificing quality—they feel more comfortable choosing that option.

Appeal To Your Audience’s Money Personality

This strategy is about finding the best messaging and marketing tactics to make customers believe your products are worth their cost.

To achieve this goal, you need to have a crystal clear picture of your target audience, as this knowledge factors into every layer and aspect of your business, including how you sell your customers on the cost of your products or services.

In addition to knowing your audience’s demographics, you also need to know their spending personality. Are they more conservative with their cash or more liberal? Or maybe they’re somewhere in between.

Your audience’s spending personality factors into how you reduce friction in your marketing and convince more people to buy. Depending on the source you look at, there are several basic money personalities:

The Big Spender

This money personality enjoys spending money, especially on new “toys,” like fancy cars and the latest gadgets—anything that makes a statement. Big spenders tend to seek top-of-the-line, name-brand items. And they don’t worry about racking up debt to acquire the latest and greatest.

The Saver

This money personality keeps a tight rein on their finances. They’re usually debt-free and want to stay that way. When they do spend money, they do so out of necessity more than desire. Savers care a lot about growing their nest eggs.

The Shopper

This money personality is the type to engage in “retail therapy,” deriving a sense of emotional satisfaction from shopping. Shoppers don’t need to buy top-of-the-line the way that big spenders do, though. Shoppers love a good deal and they don’t shy away from bargain-hunting.

The Investor

This money personality is aware of their finances and they try to put their money to good use. Investors aren’t risk-averse with their money, but they don’t jump the gun when making purchases either. Investors do their homework and make decisions carefully.

Each money personality is motivated to take action via different marketing angles, and your messaging needs to reflect that. For example, if big spenders are your target audience, you wouldn’t want your marketing to focus on your product’s practicality or its good value, as big spenders don’t care about these things. Instead, you’d pitch the product as a luxury item that’s worth the splurge.

Conclusion

A lot of thought and consideration needs to go into your offers’ prices. And perhaps the most important thing you can do with your prices is to test. If you don’t test, you’re guessing. While the guesses may be educated and based on best practices like the ones discussed above, if you don’t test, you can’t know with any certainty how effective a pricing strategy is for your business.

To learn more about pricing strategies and split-testing, give us a call or contact us here. We’d love to chat to see how we can help improve your business!

What are your thoughts about these pricing tips and strategies? What other advice can you share? Please leave a comment below and share any questions or insights!